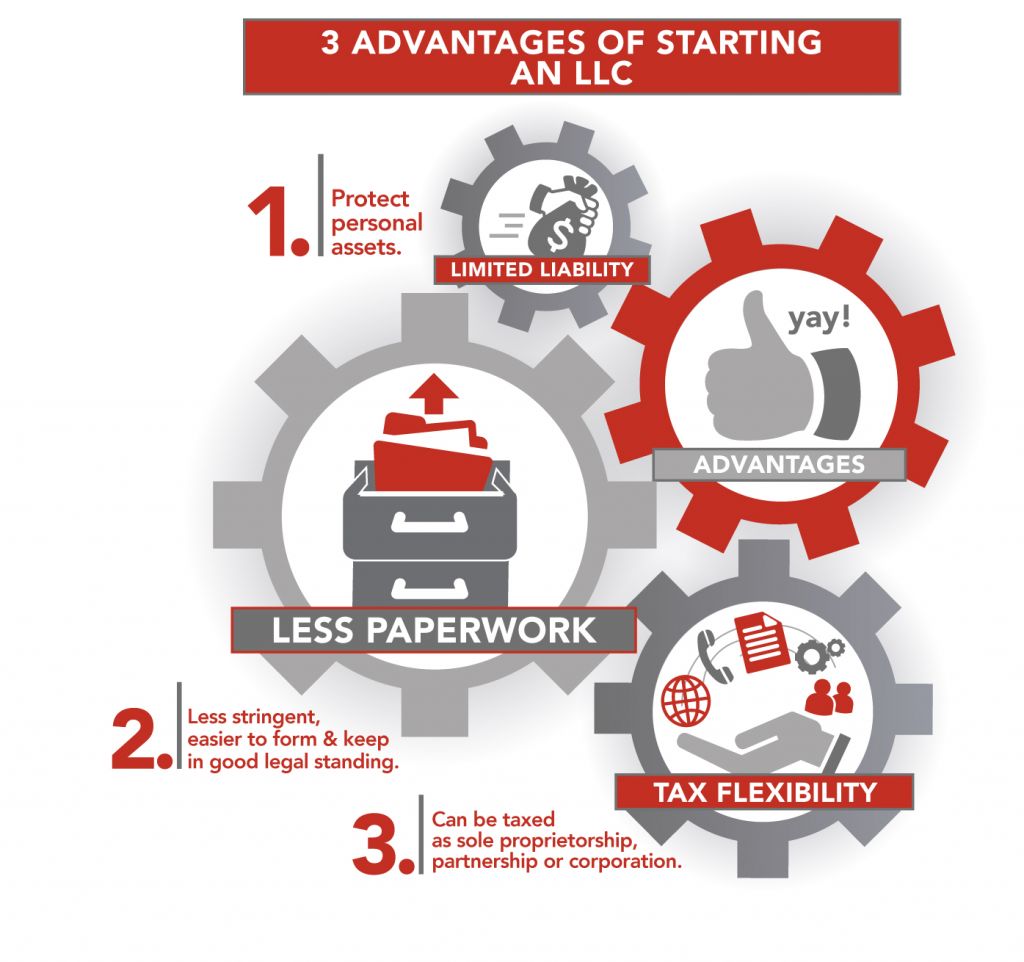

1. Limited Liability

1. Limited Liability

The most popular reason people form an LLC is to protect their personal assets. LLCs ensure that, legally, you are not held personally responsible for the debts and liabilities as a result of the company’s business. This avoids personal litigation, seizure of personal property, and bankruptcy.

2. Less Paperwork

Paperwork for this type of company is not as demanding as, for example, incorporated businesses. An LLC can be formed by filing articles of organization and submitting a fee to the state but does not require filing annual reports, creating management bylaws, and other administrative work required when incorporating a business.

3. Tax Flexibility

Though the guidelines for running an LLC differ from other types of companies, they can be taxed as a sole proprietorship, partnership, or corporation. There is more flexibility on how the business is classified when it comes to taxes since an LLC is not recognized by the IRS as a taxing entity.

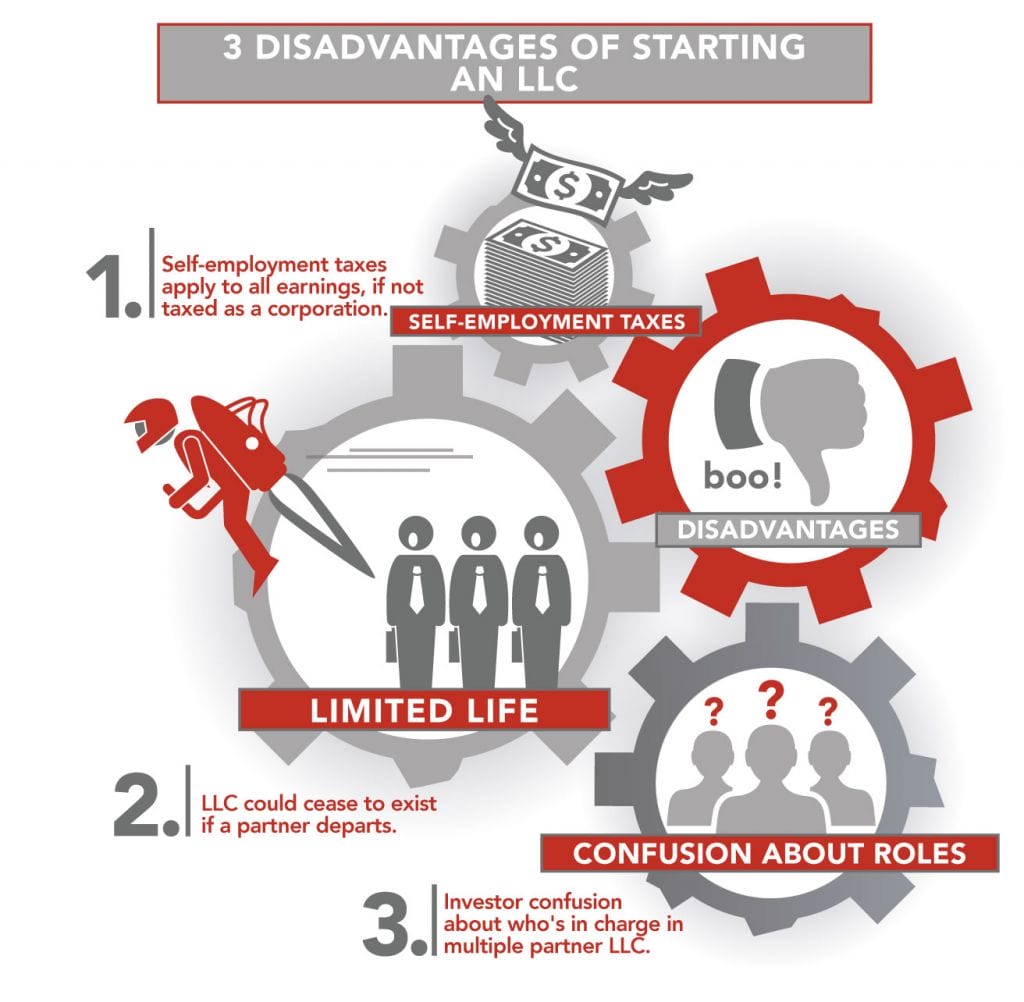

1. Self-Employment Taxes

If you choose not to tax your LLC as a corporation, it is considered a pass-through business and the taxes are passed through to the owners. This means that the net income is divided equally between owners and each owner will pay that share’s tax on their personal income tax return. In some cases, LLC owners may end up paying more taxes than corporation owners would since profits are taxed instead of salaries.

2. Limited Life

In some states, the departure of a partner may force an LLC to dissolve. Ownership of an LLC is harder to transfer than that of a corporation since there are no shares of stock that can be sold and altering ownership must be approved by existing LLC members. If members do not buy the departing partner’s interests at fair market value, the LLC may be dissolved.

3. Confusion About Roles

Single-member LLC ownership is straightforward since one member has all decision-making power, however, multiple-member LLCs can be more complicated. Without clear guidelines of the rights and responsibilities of company members in the Operating Agreement, disagreements can quickly arise.

Whether deciding to categorize your company as an LLC or incorporating, Simply Counted can help you get started. Our strategic business consulting can advise on the formation of a new business, while our CFO and accounting services will assist long-term to ensure that your day-to-day operations run smoothly and efficiently so that you can focus on what makes your company unique.

About the Author

Diana Kasza

Former President of Simply Counted Business Services, Inc.Diana is an Accredited Business Accountant/Consultant with more than 25 years of experience. She is a graduate of Ferris State University and an active member of Toastmasters International.